Click to expand.

Click to expand.

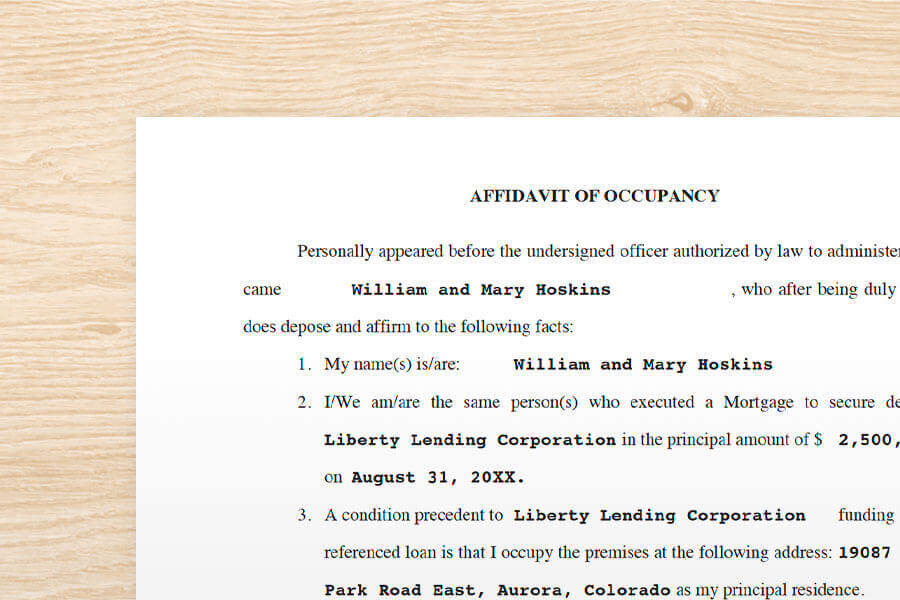

Notary Signing Agents deal with a wide array of complex documents during a mortgage loan signing, including many with special or unusual requirements. In this article, we’ll answer questions about the Occupancy Affidavit.

What is an Occupancy Affidavit?

An Occupancy Affidavit is a document in which a homeowner confirms that a property being financed will serve as the homeowner's principal residence.

What is the purpose of an Occupancy Affidavit?

Lenders typically offer lower interest rates to homeowners who occupy a principal residence because there is less risk to the property being properly maintained when the homeowner lives there than when the homeowner is absent (as with a rental property, vacation home, etc.).

Are Occupancy Affidavits known by other names?

Yes. An Occupancy Affidavit may also be referred to as a “Statement of Occupancy,” “Occupancy Statement,” “Occupancy Certification,” “Owner Occupancy Letter,” “Residency Affidavit,” or by other names as well. Sometimes it can be titled "Occupancy and Financial Status Affidavit" or similar. This form includes both statements of occupancy and a borrower's financial status in one form.

What types of loan document packages include an Occupancy Affidavit?

Occupancy Affidavits are commonly found in residential purchase and refinance loan packages.

Does an Occupancy Affidavit require notarization?

Some do, while others do not. Most lenders require an Occupancy Affidavit to be notarized with a verification upon oath or affirmation or jurat, with the borrower signing the Affidavit and swearing or affirming the statement’s truthfulness in the Notary’s presence. There are some forms of Occupancy Affidavits that may require an acknowledgment instead. There are even forms that require no notarization at all. Regardless of whether an Occupancy Affidavit is notarized, making a false statement on an Occupancy Affidavit can result in serious penalties, including fines or even imprisonment. Notary Signing Agents should carefully check the Occupancy Affidavit appearing in the loan package for a notarial certificate at the end to determine if it requires notarization, and if so, which one.

David Thun is the Editorial Manager at the National Notary Association.

Related Articles:

Notary Signing Document FAQ: Signature and Name Affidavits

Signing Agent tip: Explaining loan documents — What you can and cannot do

Additional Resources:

The Notary Signing Agent’s Loan Documents Sourcebook