The Office of the Comptroller of the Currency (OCC) last week issued an alert informing banks and financial institutions that they must create and implement an oversight and risk management plan for supervising all of their third party service providers — such as title companies and the vendors they hire.

The Office of the Comptroller of the Currency (OCC) last week issued an alert informing banks and financial institutions that they must create and implement an oversight and risk management plan for supervising all of their third party service providers — such as title companies and the vendors they hire.

The October 30th Guidance, which in many respects mirrors a Consumer Financial Protection Bureau (CFPB)alert issued in April 2012, adds yet another layer of regulatory framework to the financial sector, which has been heavily hit with reform measures in recent years. The heightened standards will hold banks and other institutions liable for wrongdoings or non-compliance violations committed by their providers, in an effort to create a stronger chain of accountability throughout the financial sector.

“We have concerns regarding the quality of risk management on the growing volume, diversity, and complexity of banks’ third-party relationships,” said Comptroller of the Currency Thomas J. Curry. “This guidance provides more comprehensive instruction for banks to ensure these relationships and activities are conducted in a safe and sound manner.”

Lenders and title companies have already established new standards for mortgage signings under the auspices of the Signing Professionals Workgroup. Those standards are expected to be implemented in early 2014.

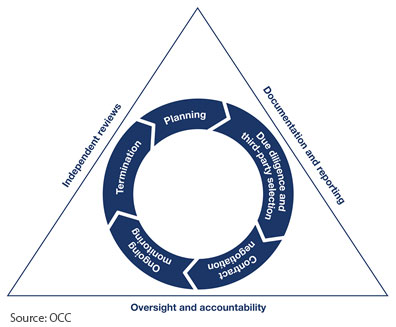

Officially called the OCC Bulletin 2013-29, the updated guidance is largely focused on the development of a well-documented oversight program and clear reporting strategies. Organizations will be required to show they have created a risk management plan that ensures the ongoing monitoring and reporting of all of their providers’ activities and performance, as well as a contingency plan for terminating third party relationships.

The OCC guidance applies to all banks and organizations that conduct business using third parties, including community banks and smaller institutions. The guidance also states that the OCC expects more stringent oversight procedures to be in place for providers serving a critical function in certain “high-risk” activities.

For more information, the OCC has released a detailed description of its Risk Management Guidance.

Kelle Clarke is a Contributing Editor with the National Notary Association.